United Payments Interface (UPI), an Indian instant digital payments system made by the National Payments Corporation of India (NPCI), registers an all-time high transaction of INR 23,24,699.91 Crore. India made around 49% of the global real-time payment transactions in 2023. As of all the payments made in India, around 40 percent are digital, while UPI sits over the biggest chunk.

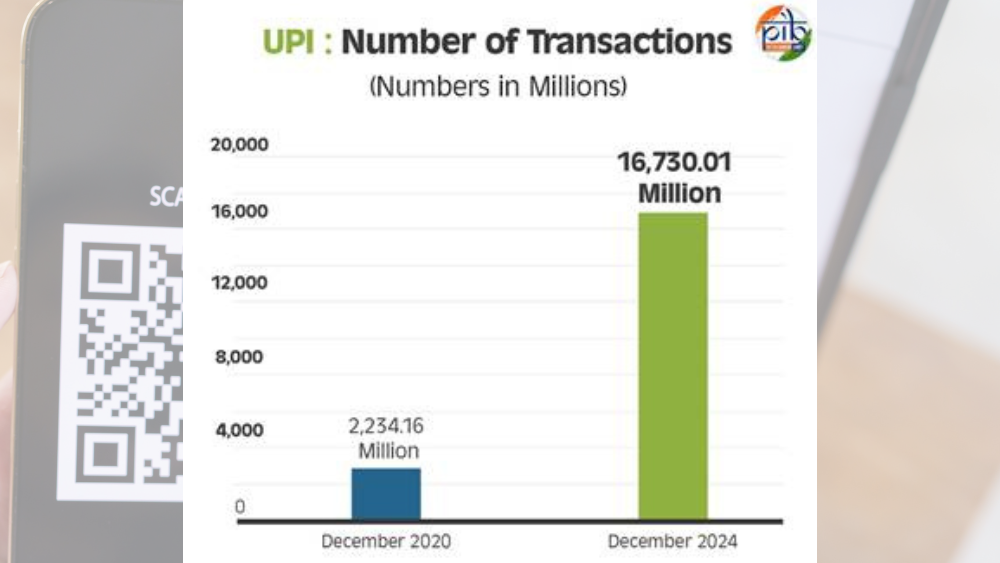

As a matter of UPI transactions, it also reached an all-time high of 16,730.01 million transactions, in contrast to 1.99 million in December 2016 and 2,234.16 million in December 2020. The UPI figures-transactions or the volume of total transactions, both continue to grow expeditiously. This holds the potential to turn India’s digital payments ecosystem more robust and seamless.

UPI: Growing Network of Live Banks

From the time it began to 2024, 641 banks are live on UPI, as compared to December 2016, when it was 35 banks only, and December 2020, when it was 207 banks only. This signifies the growing ecosystem of UPI with more banks in its ambit. Hence, making it a long-term and effective solution for the Indian digital payments ecosystem.

Read the latest in Fintech at: Secretary Financial Servies, GoI holds discussions with fintech startups, RBI, and NPCI among others

UPI: Goes Global

UPI Now Powers Seamless Live Transactions Across 7 Countries, Including Key Markets Like UAE, Singapore, Bhutan, Nepal, Sri Lanka, France, and Mauritius. This milestone underscores UPI's growing global presence and its role in simplifying cross-border payments. This signifies the growing acceptance of UPI for its accessibility and convenience.