The Telecom Regulatory Authority of India (TRAI) has recently released its report on the data of telecom subscribers in India. According to the data reported in the recent release 13.45 million subscribers submitted their requests for Mobile Number Portability (MNP) in October taking the total tally of MNP to 1052.56 million at the end of October-24 from 1039.11 million at the end of September-24. This growth, however, comes alongside a concerning decline in the overall subscriber base across both urban and rural regions.

Broadband subscribers

As per the report, total broadband subscribers in India stood at 941.47 Million at the end of October as compared to 944.40 million at the end of September 24. The particular segment has registered a decline of around 0.31%.

With 474.81 Million subscribers, Reliance Jio Infocomm stands in first place while Bharti Airtel stands in second place with around 287.67 Million.

Wireless subscribers

As per the report, total wireless subscribers have decreased from 1,153.72 million at the end of September-24, to 1,150.42 million at the end of October-24, thereby registering a monthly decline rate of 0.29%.

Interestingly, the report counts in a decline in the subscriber base in rural and urban areas, both. It declined from from 628.12 million at the end of September 24 to 625.56 million at the end of October 24 in urban areas, it decreased from 525.60 million to 524.86 million during the same period in the Rural areas.

Previous news by TRAI: TRAI releases recommendations on assigning additional spectrum to Indian Railways

M2M segment

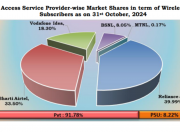

As per the report, on a positive note, the Machine-to-Machine (M2M) cellular mobile connections increased from 54.64 million at the end of September, 24, to 56.12 million at the end of October, 24. Bharti Airtel Limited led the segment with 29.08 million connections with a market share of 51.82% followed by Vodafone Idea Limited, Reliance Jio Infocom Limited, and BSNL with a market share of 26.75%, 15.95%, and 5.48% respectively.

In conclusion, while there are positive signs in specific segments like M2M connectivity, the overall decline in subscriber bases across various categories raises critical questions about market dynamics and consumer preferences in India's telecom sector.

Visit our Telecom Category Page to read more.